Confidential

Enhancing Tax Compliance Workflows

Highlights

Scaling Tax Automation Through Logic-First Design

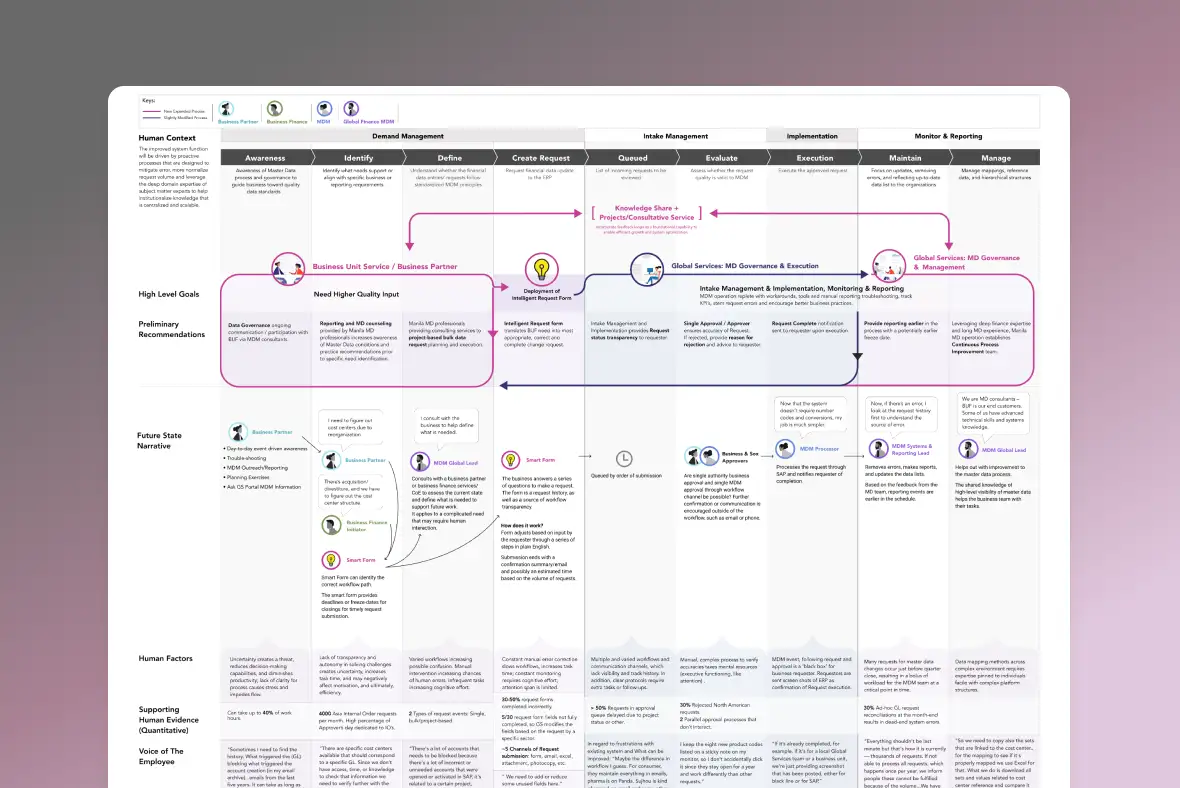

Tax teams were burdened by high-volume, repetitive manual work, creating operational fatigue and elevating compliance risk. In this environment, the cost of being slow was often eclipsed by the financial liability of human error.

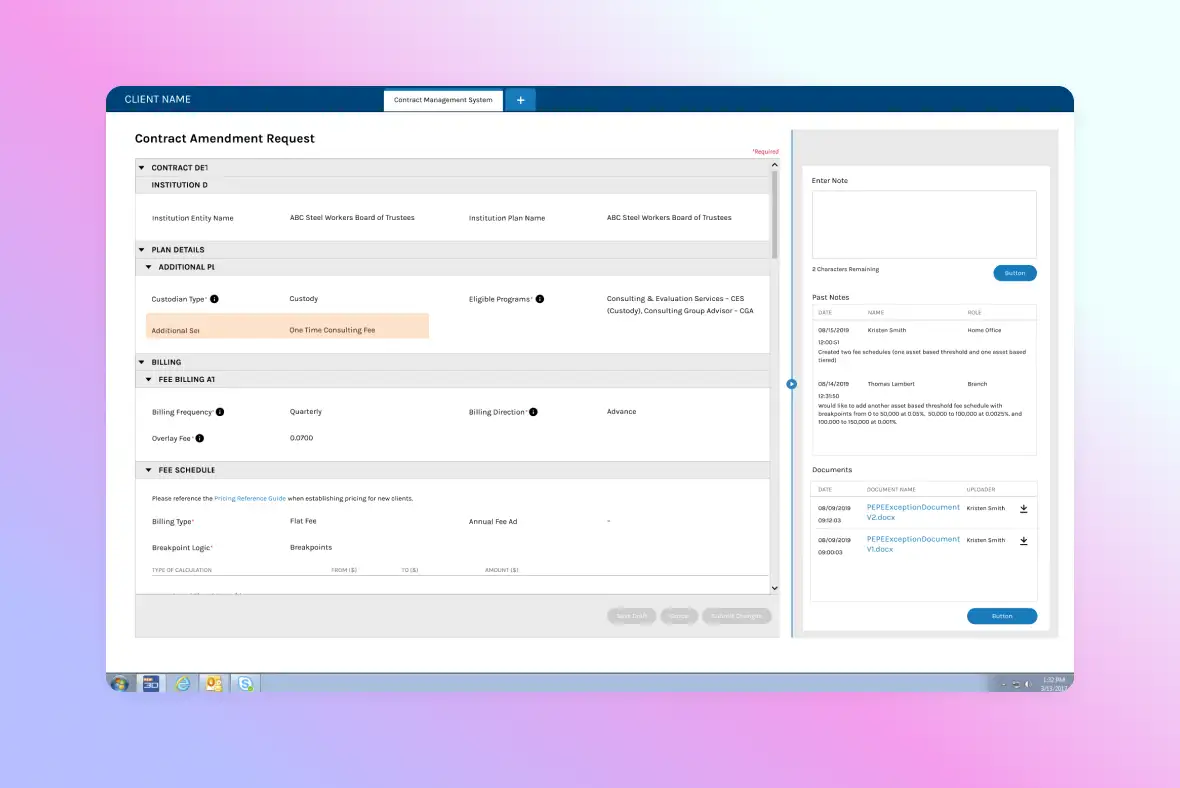

To address this, I partnered with product and engineering teams to transition manual workflows toward rule-based automation and ML-assisted decisioning. Working in a highly technical domain where logic accuracy mattered more than visual polish, I used high-fidelity wireframes as a strategic tool to anchor product vision and accelerate alignment.

This approach enabled me to:

Retrospective

Balancing Flexibility and Precision

User validation revealed that a one-size-fits-all dashboard was insufficient. Visualization needs varied significantly based on role and urgency: auditors required access to raw, inspectable data, while managers needed summarized narratives to support faster decisions.

In compliance-driven systems, flexibility is not a nice-to-have — it’s a functional requirement.

This project reinforced the value of logic-first wireframing. By prioritizing data structure and conditional behavior before aesthetics, I established a scalable foundation that supported both engineering constraints and diverse user needs — an approach I continue to apply across complex, regulated platforms.